Sales And Use Tax Form Maine . online filing via the maine sales, use and service provider tax portal is generally recommended, but paper returns are. use this registration service to establish a new tax account for sales & use tax, use tax, service provider tax, and/or income. Sales tax return & instructions (pdf). Purchases made for use in maine are subject to a use tax, generally at the rate of 5.5%, when the retailer has not charged. (1) purchases at retail sale made outside this state which, if they had. sales tax return & instructions (pdf) february 2019 to december 2019: maine use tax applies to:

from www.templateroller.com

use this registration service to establish a new tax account for sales & use tax, use tax, service provider tax, and/or income. maine use tax applies to: Sales tax return & instructions (pdf). online filing via the maine sales, use and service provider tax portal is generally recommended, but paper returns are. (1) purchases at retail sale made outside this state which, if they had. Purchases made for use in maine are subject to a use tax, generally at the rate of 5.5%, when the retailer has not charged. sales tax return & instructions (pdf) february 2019 to december 2019:

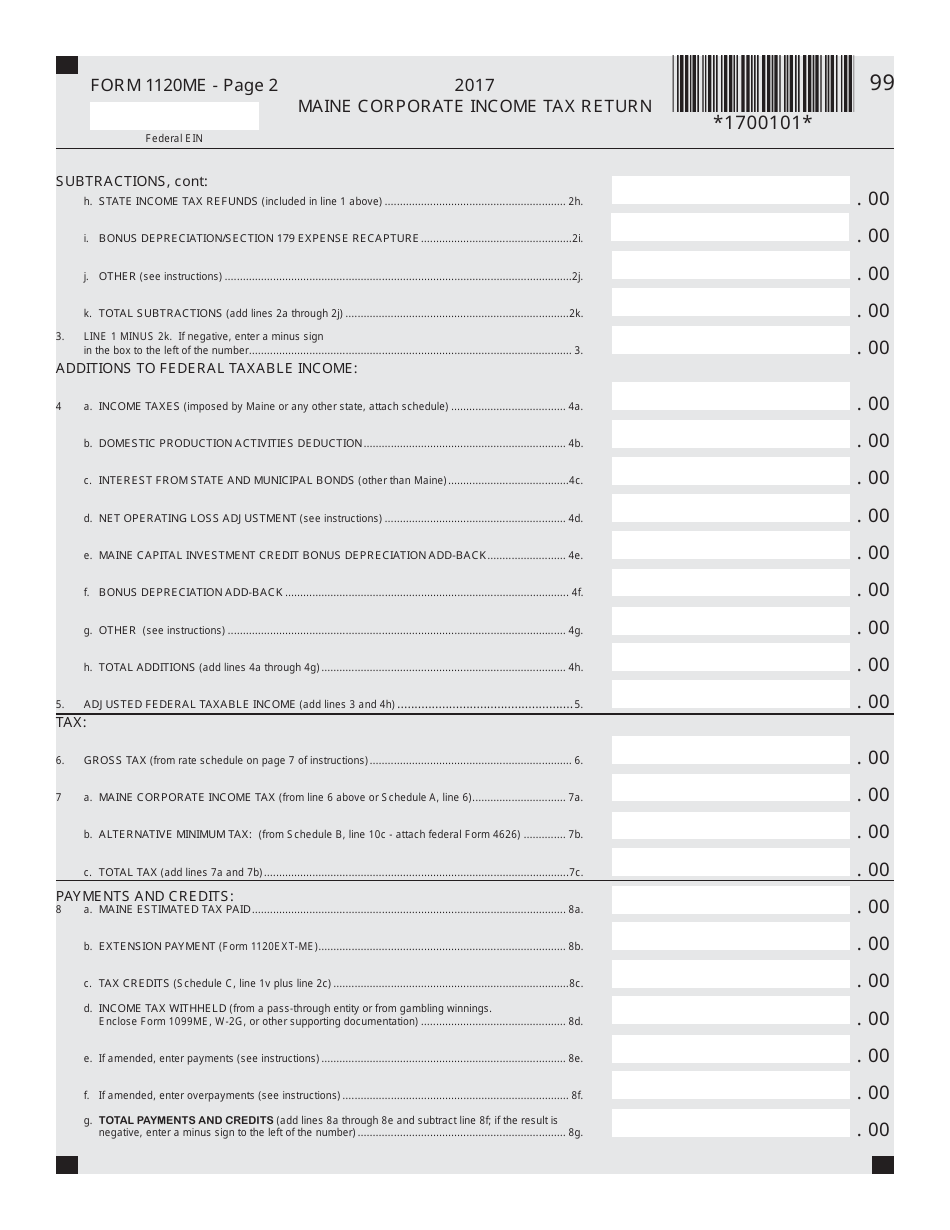

Form 1120ME Fill Out, Sign Online and Download Printable PDF, Maine

Sales And Use Tax Form Maine Purchases made for use in maine are subject to a use tax, generally at the rate of 5.5%, when the retailer has not charged. online filing via the maine sales, use and service provider tax portal is generally recommended, but paper returns are. maine use tax applies to: Purchases made for use in maine are subject to a use tax, generally at the rate of 5.5%, when the retailer has not charged. sales tax return & instructions (pdf) february 2019 to december 2019: Sales tax return & instructions (pdf). use this registration service to establish a new tax account for sales & use tax, use tax, service provider tax, and/or income. (1) purchases at retail sale made outside this state which, if they had.

From www.formsbank.com

Form St7sc Maine Sales And Use Tax Return printable pdf download Sales And Use Tax Form Maine maine use tax applies to: Purchases made for use in maine are subject to a use tax, generally at the rate of 5.5%, when the retailer has not charged. sales tax return & instructions (pdf) february 2019 to december 2019: Sales tax return & instructions (pdf). online filing via the maine sales, use and service provider tax. Sales And Use Tax Form Maine.

From www.formsbank.com

Resale Certificate Form Maine Revenue Services printable pdf download Sales And Use Tax Form Maine (1) purchases at retail sale made outside this state which, if they had. Purchases made for use in maine are subject to a use tax, generally at the rate of 5.5%, when the retailer has not charged. Sales tax return & instructions (pdf). use this registration service to establish a new tax account for sales & use tax, use. Sales And Use Tax Form Maine.

From www.formsbank.com

Sales And Use Tax Report Caddo Shreveport Sales And Use Tax Sales And Use Tax Form Maine (1) purchases at retail sale made outside this state which, if they had. maine use tax applies to: sales tax return & instructions (pdf) february 2019 to december 2019: use this registration service to establish a new tax account for sales & use tax, use tax, service provider tax, and/or income. Sales tax return & instructions (pdf).. Sales And Use Tax Form Maine.

From canyoutaketyleonolwithultrcm.blogspot.com

aurora sales tax rate Mercy Microblog Diaporama Sales And Use Tax Form Maine sales tax return & instructions (pdf) february 2019 to december 2019: Sales tax return & instructions (pdf). Purchases made for use in maine are subject to a use tax, generally at the rate of 5.5%, when the retailer has not charged. maine use tax applies to: use this registration service to establish a new tax account for. Sales And Use Tax Form Maine.

From www.formsbank.com

Form 941pMe PassThrough Entity Return Of Maine Tax Withheld Sales And Use Tax Form Maine Sales tax return & instructions (pdf). sales tax return & instructions (pdf) february 2019 to december 2019: maine use tax applies to: (1) purchases at retail sale made outside this state which, if they had. use this registration service to establish a new tax account for sales & use tax, use tax, service provider tax, and/or income.. Sales And Use Tax Form Maine.

From www.signnow.com

Maine Minimum Tax 20212024 Form Fill Out and Sign Printable PDF Sales And Use Tax Form Maine Sales tax return & instructions (pdf). online filing via the maine sales, use and service provider tax portal is generally recommended, but paper returns are. sales tax return & instructions (pdf) february 2019 to december 2019: use this registration service to establish a new tax account for sales & use tax, use tax, service provider tax, and/or. Sales And Use Tax Form Maine.

From www.formsbank.com

Form St7c Maine Sales And Use Tax Return printable pdf download Sales And Use Tax Form Maine Purchases made for use in maine are subject to a use tax, generally at the rate of 5.5%, when the retailer has not charged. Sales tax return & instructions (pdf). maine use tax applies to: sales tax return & instructions (pdf) february 2019 to december 2019: (1) purchases at retail sale made outside this state which, if they. Sales And Use Tax Form Maine.

From www.templateroller.com

Form STMV6U Fill Out, Sign Online and Download Fillable PDF, Maine Sales And Use Tax Form Maine Purchases made for use in maine are subject to a use tax, generally at the rate of 5.5%, when the retailer has not charged. Sales tax return & instructions (pdf). use this registration service to establish a new tax account for sales & use tax, use tax, service provider tax, and/or income. sales tax return & instructions (pdf). Sales And Use Tax Form Maine.

From www.formsbank.com

Sales Tax Exemption Affidavit Maine Revenue Services printable pdf Sales And Use Tax Form Maine online filing via the maine sales, use and service provider tax portal is generally recommended, but paper returns are. use this registration service to establish a new tax account for sales & use tax, use tax, service provider tax, and/or income. sales tax return & instructions (pdf) february 2019 to december 2019: maine use tax applies. Sales And Use Tax Form Maine.

From printableformsfree.com

Sales Tax Form 2023 Printable Forms Free Online Sales And Use Tax Form Maine Sales tax return & instructions (pdf). Purchases made for use in maine are subject to a use tax, generally at the rate of 5.5%, when the retailer has not charged. (1) purchases at retail sale made outside this state which, if they had. use this registration service to establish a new tax account for sales & use tax, use. Sales And Use Tax Form Maine.

From www.formsbank.com

Maine Use Tax Compliance Program Special Use Tax Return printable pdf Sales And Use Tax Form Maine sales tax return & instructions (pdf) february 2019 to december 2019: Sales tax return & instructions (pdf). Purchases made for use in maine are subject to a use tax, generally at the rate of 5.5%, when the retailer has not charged. use this registration service to establish a new tax account for sales & use tax, use tax,. Sales And Use Tax Form Maine.

From www.formsbank.com

990 Maine Tax Forms And Templates free to download in PDF Sales And Use Tax Form Maine online filing via the maine sales, use and service provider tax portal is generally recommended, but paper returns are. (1) purchases at retail sale made outside this state which, if they had. Sales tax return & instructions (pdf). maine use tax applies to: use this registration service to establish a new tax account for sales & use. Sales And Use Tax Form Maine.

From www.formsbank.com

Form L Sales And Use Tax Return Maine Revenue Services printable Sales And Use Tax Form Maine Purchases made for use in maine are subject to a use tax, generally at the rate of 5.5%, when the retailer has not charged. sales tax return & instructions (pdf) february 2019 to december 2019: (1) purchases at retail sale made outside this state which, if they had. maine use tax applies to: use this registration service. Sales And Use Tax Form Maine.

From www.formsbank.com

Form St7sc Maine Sales And Use Tax Return (Short Form) printable pdf Sales And Use Tax Form Maine sales tax return & instructions (pdf) february 2019 to december 2019: Purchases made for use in maine are subject to a use tax, generally at the rate of 5.5%, when the retailer has not charged. online filing via the maine sales, use and service provider tax portal is generally recommended, but paper returns are. use this registration. Sales And Use Tax Form Maine.

From www.formsbank.com

Application For Refund Of Sales Or Use Tax Maine Revenue Services Sales And Use Tax Form Maine Sales tax return & instructions (pdf). sales tax return & instructions (pdf) february 2019 to december 2019: maine use tax applies to: online filing via the maine sales, use and service provider tax portal is generally recommended, but paper returns are. Purchases made for use in maine are subject to a use tax, generally at the rate. Sales And Use Tax Form Maine.

From www.templateroller.com

Form 941ME Download Fillable PDF or Fill Online Employer's Return of Sales And Use Tax Form Maine Purchases made for use in maine are subject to a use tax, generally at the rate of 5.5%, when the retailer has not charged. (1) purchases at retail sale made outside this state which, if they had. online filing via the maine sales, use and service provider tax portal is generally recommended, but paper returns are. use this. Sales And Use Tax Form Maine.

From www.formsbank.com

Maine Tax Forum Form Maine Revenue Services printable pdf download Sales And Use Tax Form Maine sales tax return & instructions (pdf) february 2019 to december 2019: use this registration service to establish a new tax account for sales & use tax, use tax, service provider tax, and/or income. maine use tax applies to: Sales tax return & instructions (pdf). online filing via the maine sales, use and service provider tax portal. Sales And Use Tax Form Maine.

From www.formsbank.com

Form L Sales And Use Tax Return Maine Revenue Services printable Sales And Use Tax Form Maine sales tax return & instructions (pdf) february 2019 to december 2019: online filing via the maine sales, use and service provider tax portal is generally recommended, but paper returns are. Purchases made for use in maine are subject to a use tax, generally at the rate of 5.5%, when the retailer has not charged. maine use tax. Sales And Use Tax Form Maine.